Will Insurance Pay for Rhinoplasty with Deviated Septum

Will Insurance Pay for Rhinoplasty with Deviated Septum The landscape of health insurance is a labyrinth, especially when coverage pertains to specific procedures like rhinoplasty. Many ponder whether their policy would shoulder the cost if it were medically necessitated by conditions such as a deviated septum. This question isn’t straightforward and demands an inspection of multiple factors, including understanding what rhinoplasty entails.

Rhinoplasty – a term often tossed around yet misunderstood – serves to rectify structural issues within the nose. In certain cases, these problems lead to functional impairments; one common condition is a deviated septum which can cause breathing difficulties or recurrent sinus infections. The interplay between medical necessity and insurance policies becomes crucial here, given that many companies cover treatments deemed essential for patient well-being.

In navigating this maze of information regarding insurance aspects related to rhinoplasty due to a deviated septum, there are guidelines worth considering. These aim at demystifying how typical coverage scenarios unfold while shedding light on exceptions where consultation with your insurer becomes imperative.

What is Rhinoplasty?

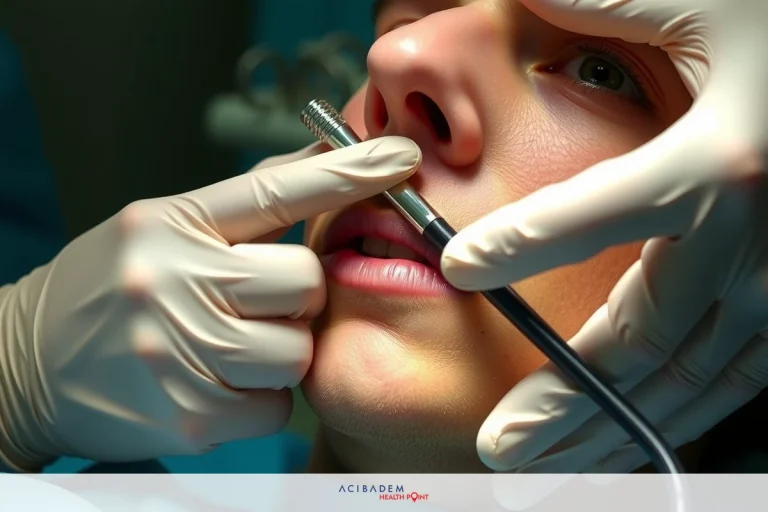

Rhinoplasty, often colloquially referred to as a “nose job,” is more than an aesthetic procedure. It’s a surgical intervention designed to reshape or resize the nose for functional or cosmetic reasons. The term ‘rhinoplasty’ originates from two Greek words: ‘Rhino’ (Nose) and ‘Plassein’ (to shape). While many might associate rhinoplasty with altering appearances, it serves critical purposes in correcting structural defects that can hamper normal breathing.

A significant portion of rhinoplasties are performed due to a condition known as deviated septum. Medically termed nasal septum deviation, this occurs when the thin wall between your nostrils leans towards one side, leading to an uneven distribution of space for air passage. In severe cases, this may cause difficulty breathing through one or both sides of the nose and lead to recurrent sinus infections. When such symptoms become problematic enough to affect daily life quality, doctors often recommend corrective surgery – i.e., rhinoplasty.

Insurance coverage for these procedures becomes relevant here; after all, the cost can be substantial depending on complexity and regional pricing variations. Most

insurance policies typically cover medically necessary procedures such as correctional surgeries for deviated septums under certain conditions – though specifics vary per plan details and policy provider guidelines. This underscores why understanding terms like ‘medical necessity,’ especially in relation with conditions like deviated septum requiring possible rhinoplasty intervention becomes crucial if you’re considering your options.

Medical Necessity for Rhinoplasty

The term ‘medical necessity’ is of significant importance in the realm of health insurance policies and coverage. It serves as a determinant factor guiding whether an insurer will provide coverage for specific procedures, including rhinoplasty due to a deviated septum. This pivotal phrase hinges on demonstrating that the procedure in question – rhinoplasty, in this context – is not just advisable but indispensable for maintaining or improving the patient’s health status.

When it comes to deviated septums, medical necessity manifests when symptoms are severe enough to disrupt daily life significantly. Such symptoms might include chronic sinus infections, frequent nosebleeds, facial pain or pressure, difficulty breathing through one or both nostrils, snoring during sleep and recurrent headaches – all potentially linked back to an improperly aligned nasal septum. In these instances, conservative treatments such as

medications often prove inadequate; surgical intervention becomes necessary hence qualifying as a medical need.

However, proving medical necessity requires more than subjective discomfort; objective evidence plays a crucial role too. Diagnostic tests like computed tomography

(CT) scans can visually confirm deviations while physical examinations reveal symptomatic manifestations attributable to the condition. These evidential aspects form part of your claim when seeking insurance coverage for rhinoplasty related to deviated septum corrections – making them vital elements worth understanding before initiating any conversations with your policy provider.

Insurance Coverage for Rhinoplasty

The interplay between insurance coverage and rhinoplasty is complex, particularly when the procedure relates to a deviated septum. Each insurance company has its own set of policies and guidelines on what they consider medically necessary, affecting whether or not they will cover the costs involved in such a surgery. It’s essential therefore to evaluate your specific policy details before proceeding with any medical intervention.

Typically, if rhinoplasty is deemed medically necessary due to severe symptoms from a deviated septum–which might include chronic sinusitis, breathing difficulties or obstructive sleep apnea–insurance plans may offer some level of coverage. However, this often requires comprehensive documentation demonstrating that conservative management measures have failed and that surgical correction would significantly improve quality of life. This includes but isn’t limited to diagnostic test results as well as detailed notes from health care providers establishing the severity and persistence of symptoms.

It’s worth noting though that even within these parameters, how much an insurer covers can vary widely based on plan-specific deductibles, co-pays and out-of-pocket maximums – factors one should take into account while planning financially for potential procedures like rhinoplasty. Additionally, it’s always advisable to consult directly with your insurer regarding their specific criteria for covering such surgeries related to deviated septums; knowledge which could save you from unexpected financial burdens down the line.

Frequently Asked Questions

What is a deviated septum?

A deviated septum occurs when the thin wall between your nostrils, known as the nasal septum, leans towards one side. This can lead to an uneven distribution of space for air passage through each nostril and potentially cause issues like difficulty breathing or recurrent sinus infections.

How do I know if my rhinoplasty will be covered by insurance?

Insurance coverage for rhinoplasty largely depends on whether it's considered medically necessary due to severe symptoms related to a condition such as a deviated septum. You'll need comprehensive documentation demonstrating that non-surgical treatments have failed and that surgical intervention would significantly improve your quality of life. Always consult directly with your insurer regarding their specific criteria for coverage.

What does 'medical necessity' mean in terms of insurance coverage for rhinoplasty?

Medical necessity refers to the requirement that a procedure (like rhinoplasty) must not just be advisable but indispensable in maintaining or improving patient health status. In terms of a deviated septum, this becomes relevant when symptoms are severe enough to disrupt daily living conditions.

Will insurance cover all costs involved in my rhinoplasty surgery?

The extent of the cost covered by insurance may vary widely based on plan-specific details including deductibles, co-pays and out-of-pocket maximums. It's crucial therefore to understand these aspects before planning financially for potential procedures like rhinoplasty